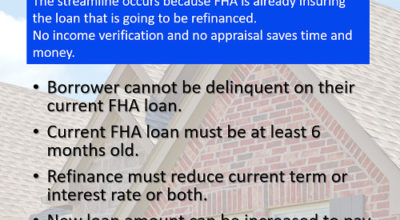

This streamline program is available for refinance situations because FHA is already insuring the loan. VA & USDA have similar programs.

Blog

Mortgage Closing Scams

The American bank robber, Willie Sutton, was asked why he robbed banks and his answer was “because that is where the money is.” During his 40-year career, he stole about…Read More→

ACT – Safe at Home

Safe at home is a perspective that can change attitude.